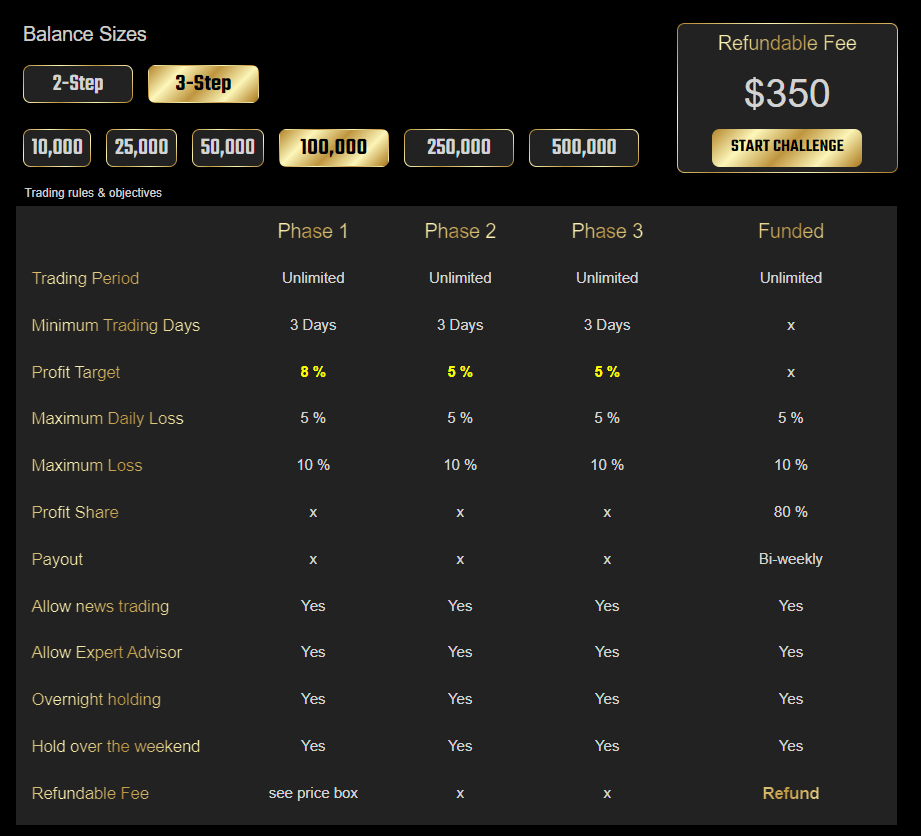

Our 3-Step Challenge is the evaluation process, which consists of three phases to be passed.

The main difference between the 2-Step Challenge and the 3-Step Challenge is the Profit Target that needs to be achieved.

In our 3 Step Challenge you only need to achieve a Profit Target of 8% of the initial balance in the Phase 1 of the Evaluation process. Here we put more emphasis on your trading consistency among other parameters. The Phase 2 and the Phase 3 Profit target is the same which is only 5%.

For example: If you trade FCT Challenge with a $100,000 account balance, your profit target is $8,000 in the Phase 1 and then $5,000 in the Phase 2 and Phase 3 of the Evaluation process.

There is no time limit in which you must pass the Profit Target, the Trading Period is unlimited. As soon as all Trading Objectives in your first Evaluation Stage are met and your results are reviewed, you can move on to the Second Evaluation stage, and so on. The minimum time to complete each Evaluation stage is 3 trading days.

Following are the 3-Step Challenge Trading Objectives

- Evaluation Process

- Phase 1

- This is the first stage that you have to pass by achieving the given profit target of 8% of the initial balance without going below your daily or maximum drawdown limits.

- This is the first stage that you have to pass by achieving the given profit target of 8% of the initial balance without going below your daily or maximum drawdown limits.

- Phase 2

- The Phase 2 is the second stage of your Evaluation Process. The purpose of the Phase 2 stage is to test your trading consistency. We need to be sure that you can trade your style or strategy profitably in the long run while respecting the rules. The Phase 2 stage has easier Trading Objectives compared to the Phase 1 as the Profit Target is only 5%. And just like in the Phase 1, you have an unlimited amount of time to pass.

- The Phase 2 is the second stage of your Evaluation Process. The purpose of the Phase 2 stage is to test your trading consistency. We need to be sure that you can trade your style or strategy profitably in the long run while respecting the rules. The Phase 2 stage has easier Trading Objectives compared to the Phase 1 as the Profit Target is only 5%. And just like in the Phase 1, you have an unlimited amount of time to pass.

- Phase 3

- The Phase 3 is the third and final stage of your Evaluation Process. Profit Target is the same with Phase 2 which is only 5%. And just like in the Phase 1 and Phase 2, you have an unlimited amount of time to pass.

As soon as you succeed in Phase 3 Trading Objectives and your results are reviewed, you can then complete your KYC/AML screening process and sign the contract for your FCT Funded Account. No need to wait any longer!

- The Phase 3 is the third and final stage of your Evaluation Process. Profit Target is the same with Phase 2 which is only 5%. And just like in the Phase 1 and Phase 2, you have an unlimited amount of time to pass.

- Phase 1

- Trading Period

- Peace of mind is absolutely crucial in order to be able to fully focus on your trading performance. We don't want to put our traders under unnecessary pressure and therefore, the Trading Period is completely unlimited. With FCT, you can take as much time as you need to reach your Profit Target.

- Peace of mind is absolutely crucial in order to be able to fully focus on your trading performance. We don't want to put our traders under unnecessary pressure and therefore, the Trading Period is completely unlimited. With FCT, you can take as much time as you need to reach your Profit Target.

- Minimum Trading Days

- To meet this objective, you must open a new trade for at least 3 days. At least one position must be opened on each of these days. A trading day is defined as a day when at least one trade is executed. If a trade is held over multiple days, only the day when the trade was executed is considered to be the trading day.

- To meet this objective, you must open a new trade for at least 3 days. At least one position must be opened on each of these days. A trading day is defined as a day when at least one trade is executed. If a trade is held over multiple days, only the day when the trade was executed is considered to be the trading day.

- Maximum Loss or Maximum Drawdown

- This rule can also be called “account stop-loss”. The equity of the trading account must not, at any moment, decline below 90% of the initial account balance. For an FCT Challenge with a balance of $100,000, it means that the account lowest possible equity can be $90,000. Again, this is a sum of both closed and open positions (account equity, not balance). This loss Limit is inclusive of commissions and swaps. 10% of the initial account balance gives traders enough space to prove that their account is suitable for leading an investment. It is a buffer that should keep the trader in the game even if there were some initial losses. The investor has an assurance that the trader’s account cannot decline below 90% of its value under any circumstance.

- This rule can also be called “account stop-loss”. The equity of the trading account must not, at any moment, decline below 90% of the initial account balance. For an FCT Challenge with a balance of $100,000, it means that the account lowest possible equity can be $90,000. Again, this is a sum of both closed and open positions (account equity, not balance). This loss Limit is inclusive of commissions and swaps. 10% of the initial account balance gives traders enough space to prove that their account is suitable for leading an investment. It is a buffer that should keep the trader in the game even if there were some initial losses. The investor has an assurance that the trader’s account cannot decline below 90% of its value under any circumstance.

- Maximum Daily Loss

- This rule can also be called “trader’s daily stop-loss”. According to our rules, this is set as 5% from the initial account balance. The rule says that at any moment of the day (GMT +00), the result of all closed positions in sum with the currently open floating P/Ls (profits/losses) must not hit the determined daily loss limit.

Here is the counting formula:

Current daily loss = results of closed positions of this day + result of open positions.

For example, in the case of an FCT Challenge with the initial account balance of $100,000, the Max Daily Loss limit is $5,000. If you happen to lose $4,000 in your closed trades, your account must not decline more than $1,000 this day. It must also not go -$1,000 in your open floating losses. The limit is inclusive of commissions and swaps.

Vice versa, if you profit $4,000 in one day, then you can afford to lose $9,000, but not more than that. Once again, be reminded that your Maximum Daily Loss counts your open trades as well. For example, if in one day, you have closed trades with a loss of $3,000 and then you open a new trade that at a time goes into a floating loss of some -$2,500 but ends up positive in the end, unfortunately, it is already too late. In one moment, your daily loss was -$5,500 on the equity, which is more than the permitted loss of $5,000.

Be cautious!

As the Maximum Daily Loss resets every day (at 9 PM GMT +00)! Let’s say that one day you had a profit of $2,000. On the same day, you have an open position with a currently floating loss of $6,000. On this day, the maximum daily loss is not violated. The current daily loss is $4,000 ($2,000 closed profit – $6,000 open position). However, if you hold this position with an open loss of $6,000 after the Daily Loss reset time, the daily loss limit will be violated. This is because your previous day profit doesn’t count to a new day and the open loss of $6,000 exceeds the maximum daily permitted loss of $5,000.

The size of the Maximum Daily Loss gives trader enough space for trading and it guarantees a clearly defined daily risk to the investor. Both the trader and investor benefit from this rule as the account value will not drop below the limit. That’s also why the Maximum Daily Loss limit includes your possible floating losses.

- This rule can also be called “trader’s daily stop-loss”. According to our rules, this is set as 5% from the initial account balance. The rule says that at any moment of the day (GMT +00), the result of all closed positions in sum with the currently open floating P/Ls (profits/losses) must not hit the determined daily loss limit.

- Profit Target

- The Profit Target in an FCT 3-Step Challenge is set to 8% of the initial balance for the Phase 1 and 5% for the Phase 2 and Phase 3 of the Evaluation process. A profit target means that a trader reaches a profit in the sum of closed positions on the assigned trading account anytime within the unlimited Trading Period. Also, please note that in order to proceed to the next phase, all positions must be closed.

For example: If you trade FCT Challenge with a $100,000 account balance, your profit target is $8,000 in the Phase 1 and then $5,000 in the Phase 2 and Phase 3 of the Evaluation process.

- The Profit Target in an FCT 3-Step Challenge is set to 8% of the initial balance for the Phase 1 and 5% for the Phase 2 and Phase 3 of the Evaluation process. A profit target means that a trader reaches a profit in the sum of closed positions on the assigned trading account anytime within the unlimited Trading Period. Also, please note that in order to proceed to the next phase, all positions must be closed.

- Refundable Fee

- The fee is refunded to you with your first profit share when you become an FCT Funded Trader.